With the holiday season in full swing, the shopping frenzy has begun. Millions of people do their shopping online, especially this time of year. Because of that, there is a surge of phishing attacks.

Year-End Tax Planning

Can you believe we only have a little over 6 weeks left in 2018? Time flies when you are having fun and working hard, right? Speaking of working hard, have you made more money than you were expecting and now need more write-offs to offset it? Even if you made …

It Doesn’t Have to Be a Nightmare

There are so many new laws for 2018, because of the tax reform that was passed at the end of last year. We know that it can be hard for individuals and small businesses to keep up with all of the possible deductions and changes. So, we are here to …

Are You Keeping Up?

There are so many tax law changes that will affect small business owners this year. Are you keeping up? Have you paid your estimated taxes? Do you know what expenses you can write off? If you are feeling overwhelmed, we can help.

The Advantages of an S Corporation

Are you a small business owner? When you started your business, did you set it up as an LLC? Did you just get hit with a huge tax bill? It may be time to consider filing for an S Corporation. An S corp is not a business structure, but an …

Happy Labor Day

Happy Labor Day from all of us at Miller and Associates of Arizona. We hope you get to relax and enjoy the 3-day weekend. We will be closed Monday, September 3rd.

Check Your Tax Withholding Soon

Over the last week, the IRS has been putting out several news releases encouraging tax payers to check their withholding soon. We agree; it is a very good idea for all tax payers to do do a review of their withholding. So much has changed over the last year with …

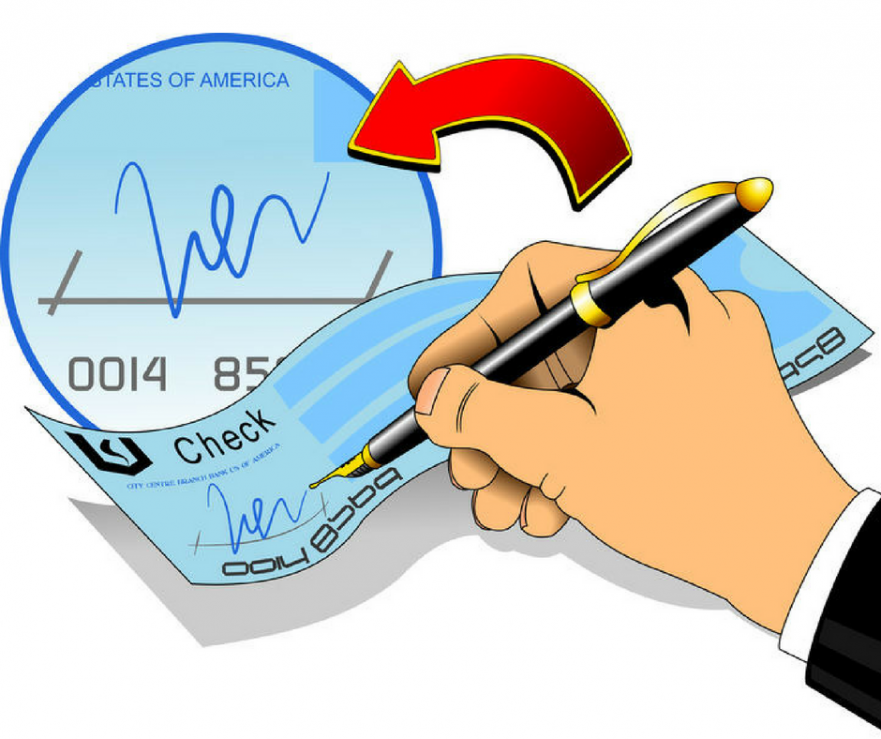

Five Tips on How to Get Paid Sooner

As a freelancer or sole proprietor, you probably count on every penny that comes in right? Do you find it difficult to get paid in a timely manner? We have heard that a lot. So, we have come up with a list of ways that may help you get paid …

Tax Credits

As tax professionals, we often get asked about tax credits and tax deductions. Some people assume they are the same thing, but they are not. A tax deduction reduces your taxable income while tax credits provide a dollar-for-dollar reduction to your income tax liability. Which means tax credits are worth …

Paycheck Checkup

Did you owe taxes or get money back this year? It will probably be different next year, because of the recent changes to the tax law. So, it would be a good idea to do a “paycheck checkup” as soon as you can. The IRS suggests this, so you don’t …